Market Insights

Friday morning, June 13th

US

- S&P 500 is hovering above the 6,000 mark again and is about 2% away from touching its 52-week high of 6,147 in February 2025.

- Analyst revised estimates for year-end targets, most of them below 6,200 with baseline between 5,900-6,000 which is where it is about now.

- S&P 500 returns in June are usually softer due to slower summer trading, but current factors can still move the market in unexpected ways. So far June has delivered about 1.9% return as of June 13th morning.

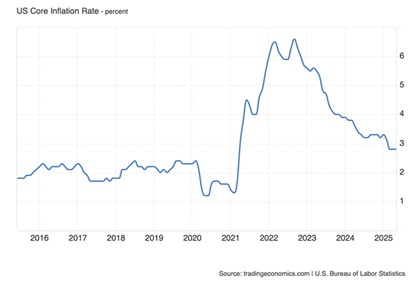

- US Core CPI, which tracks underlying inflation by excluding food and energy prices, rose 0.1% month-over-month—bringing annual inflation to 2.4%, up from 2.3%. With other central banks already cutting rates, this puts added pressure on the Fed to follow.

Figure 1: US Core inflation last 10 years.

- The market is pricing in less than 5% rate cut probability for the next FOMC meeting on June 18th as reported by CME Fedwatch. Jerome Powell, the Fed Chairman announced they will be watching how tariffs and floating trade deals materialize and overall affect the markets.

- The current rate is at 4.25-4.50% and last rate cut was in December 2024.

- It is speculated that the July 9 trade tariff’s date might be pushed out as President Trump commented that the date isn’t set in stone, potentially giving more time to consolidate trade deals.

UK & EUROPE

- The extension of the July 9 tariff deadline rattled European investors, sending all major indexes lower as ongoing negotiations keep the trade outlook uncertain.

- In the UK, two data points stood out this week: unemployment rose more than expected, climbing from 4.5% to 4.6% between February and April 2025. Meanwhile, GDP contracted by -0.3% in April after two months of consecutive positive growth, weighed down by rising taxes and US tariffs.

- For the Bank of England’s Monetary Policy Committee, this slowdown in hiring is in favor to curb on inflation that hit 3.4% in May as per Office of National Statistics (ONS) – their target inflation rate is 2%.

- For Indians studying in the UK, the current macro news is grim as this dries up long-term employment opportunities. They are fighting unemployment rates that are highest since covid-era, a pattern we are seeing play out in the US as well.

- For context: according to the UK’s Higher Education Statistics Agency (HESA) for 2023-24, Indians make up the largest group of international students in the UK, with China coming in second.

INDIA

- After hitting all-time highs in April crossing 1,00,000 rupees (10 grams, 24 karat), gold prices have surged again as of June 13th morning as Israel attacked Iran’s military and nuclear facilities.

- Many investors have been participating in the rally via passive Gold ETFs as May inflows turned positive post two consecutive months of outflows in March and April.

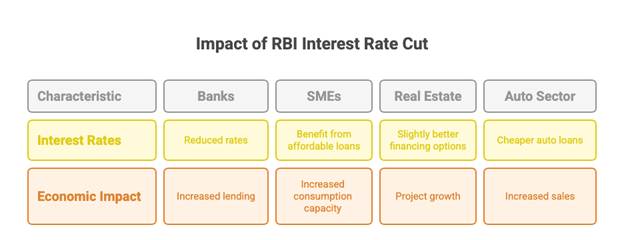

- RBI cut interest rates last week by 50 bps bringing down the interest rate to 5.50%, now maintaining a “neutral” stance from “accommodative” earlier and being more data driven moving forward. While this is a boost to the economic growth ambitions of India, we see specific sectors go through a positive domino effect.

- NIFTY 50 fell about 1% on Thursday, breaking its recent range-bound and positive streak after a sell-off triggered by weekly options expiry.

- The drop also mirrored renewed tensions between Iran and Israel, with Israeli strikes on Iranian nuclear and military sites. Oil prices spiked over 8% to ~$77 before settling back to ~$73 on June 13th as markets continued to monitor the situation.

- While India imports more than 80% of its crude oil consumption from the middle east and Russia, Iran is not India’s importing partner due to Western sanctions on the country. Nonetheless, widening of the conflict could disrupt trade routes and supply, causing oil prices to rise, thus making it more expensive for India to import.

MONDAY, JUNE 16

India

- WPI Food Index YoY (May)

- WPI Manufacturing YoY (May)

- WPI Fuel YoY (May)

- WPI Inflation YoY (May)

- Imports (May)

- Exports (May)

- Balance of Trade (May)

US

- (No major data scheduled)

UK & Europe

- (No major data scheduled)

Asia ex-India

- China House Price Index YoY (May)

- China Unemployment Rate (May)

- China Retail Sales YoY (May)

- China Industrial Production YoY (May)

TUESDAY, JUNE 17

India

- (No major data scheduled)

US

- Retail Sales Ex Autos MoM (May)

- Industrial Production MoM (May)

- Business Inventories MoM (Apr)

UK & Europe

- (No major data scheduled)

Asia ex-India

- Bank of Japan Interest Rate Decision

WEDNESDAY, JUNE 18

India

- (No major data scheduled)

US

- Initial Jobless Claims (Jun 14)

- Continuing Jobless Claims (Jun/07)

- Initial Jobless Claims (Jun/14)

- Housing Starts & Building Permits (May)

- Fed Interest Rate Decision

- FOMC Economic Projections

UK & Europe

- Core Inflation Rate YoY (May)

- Inflation Rate MoM (May)

- Core Inflation Rate YoY Final (May)

- CPI Final (May)

- Inflation Rate MoM/YoY Final (May)

- UK Retail Price Index YoY/MoM (May)

Asia ex-India

- (No major data scheduled)

THURSDAY, JUNE 19

India

- (No major data scheduled)

US

- (No major data scheduled)

UK & Europe

- Monetary Policy Committee Meeting Minutes and Vote

- ECB President Lagarde Speech

Asia ex-India

- (No major data scheduled)

FRIDAY, JUNE 20

India

- Monetary Policy Meeting Minutes

US

- (No major data scheduled)

UK & Europe

- Consumer Confidence (June)

- Retail Sales YoY

- Europe Consumer Confidence June (Flash)

Asia ex India

- Bank of Japan Meeting Minutes

- Japan Core Inflation Rate YoY (May)